In this post, we’ve reviewed the Intuit Bookkeeping Professional Certificate. Designed by a market leader in the accounting sector, this hands-on training course provides students with everything they need to launch a new career in the bookkeeping field.

By the end of this review, you’ll have a clear insight into everything you can learn with the Intuit Bookkeeping professional certificate. We’ll cover how long it takes to earn your credentials, the costs involved, and the specific lessons each module will cover.

The Intuit Bookkeeping professional certificate is a great course for developing in-demand skills in the accounting space.

The course is 100% online and comes with behind-the-scenes insights into some of the core tools you’ll use as part of your bookkeeping career.

What is Intuit Bookkeeping Certificate?

The Intuit Bookkeeping Professional Certificate is an all-in-one guide to help beginners start their new careers in bookkeeping. Designed for beginners with no prior knowledge, you’ll develop all of the professional skills you need to thrive in a new career landscape. Within only 4 months, students can learn all about key concepts in bookkeeping and accounting.

Designed by Intuit and delivered by the Coursera training platform, this program is divided into a series of four hands-on courses, which have helped 32% of graduates begin a new career. The coursework guides students through everything they need to know to apply for a role in a market where the median entry-level salary can start at around $42K per year.

Upon completion of the course, students will be awarded the Intuit Certified Bookkeeping Professional Certification. This certification prepares students to apply for any position as a bookkeeper, either with Intuit QuickBooks Live or anywhere else in the field.

Who Should Follow this Certificate?

This certificate is designed for anyone with an interest in bookkeeping and accounting. You can leverage the certificate to apply for roles as a bookkeeper, accounting clerk, Accounts Payable Specialist, or Accounts Payable Clerk.

Whether you’re just starting out in a new role or looking for a career change, the Intuit Bookkeeping Professional certificate will prepare you for a range of roles in public accounting. You’ll also be prepared for roles in private industry, government, and non-profit organization accounting.

If you’re passionate about solving the financial problems of clients, detail-oriented, and comfortable with mathematics, this program could be ideal for you. You’ll learn all about fundamental accounting principles, such as asset types, liability, equity, and financial statement analysis. Plus, there are plenty of hands-on experiences to guide you through the process of using tools like QuickBooks Online.

While there are overviews of Intuit tools like QuickBooks included in this course, you’ll also gain transferrable skills you can use with virtually any software solution.

What You’ll Learn?

The comprehensive Bookkeeping certification from Intuit helps students build a foundational knowledge of bookkeeping concepts and crucial accounting measurements. Throughout the four courses, you’ll discover what it takes to work through the various phases of the accounting cycle and how to produce essential financial statements.

Students practice interpreting and analyzing financial statements, to assist clients in making critical business decisions. The hands-on projects will also help you to build a portfolio capable of showcasing your job readiness to potential employers. You’ll also gain access to career support resources when you complete the course to help kickstart your new career.

The key components of the four courses in the certification will start you at the beginning of your new career journey, with insightful overviews into the role of a bookkeeper, what professionals in this landscape do every day, and how you’ll work in your new position. As you progress through the lessons, you’ll develop transferable skills you can take into your bookkeeping career. By the end of the certifications, students will:

- Have a foundational knowledge of bookkeeping concepts and accounting

- Know how to work through the phases of the accounting lifecycle

- Develop insights into the art of interpreting financial statements to make business decisions

- Know how to search for and access a new career in accounting or bookkeeping

- Build a comprehensive portfolio showcasing job readiness in the field

Time Investment and Certification

There are 67 hours of course content in total, including various hands-on projects, videos, and written resources. With the included hands-on projects, Intuit suggests this specialization will take around 80 hours to finish. You can pace your lessons according to your needs, but you will need to complete all 4 courses, the included projects, and the Intuit Certified Bookkeeping Professional exam.

How Much Does Intuit Bookkeeping Certificate Cost?

The total cost to get the Intuit Bookkeeping Certificate is $196. The course is offered by Coursera through the Coursera Plus subscription which costs $49 per month. On average it takes 4 months for students to complete the course and get certified.

Coursera offers a 7-day free trial to review the course material before committing to a paid plan.

Intuit Bookkeeping Certificate Contents

- Bookkeeping Basics

- Assets in Accounting

- Liabilities and Equity in Accounting

- Financial Statement Analysis

1. Bookkeeping Basics

The first course in the Intuit Bookkeeping Professional Certificate introduces beginners to the concepts of bookkeeping and accounting. This initial course lays the foundation for your knowledge of crucial business financial concepts. You’ll define what accounting is, and the elements involved in accounting measurement.

Students also learn what the role of a bookkeeper involves, looking at regular tasks and responsibilities. Plus, there are behind-the-scenes insights into the ethical and social responsibilities bookkeepers need to be aware of when maintaining the integrity of financial information.

This module is divided into four classes, with a host of quizzes, readings, and videos making up around 16 hours of content.

In week 1, students are introduced to bookkeeper roles, the accounting principle, and concepts like double-entry accounting. There are 3 readings, 19 videos, and 5 practice exercises to complete, including 4 quizzes.

In weeks 2 and 3, which take around 9 hours to complete, you’ll learn all about the Accounting cycle. Students discover how to record and monitor transactions with a general ledger and journal. There are tips on preparing unadjusted and adjusted trial balances, and overviews on creating income and balance sheets. Students also learn how to create cash flow statements, and will take part in a series of 8 practice exercises, with mandatory quizzes.

Week 4 concludes the first course with an introduction to key accounting assumptions, such as the revenue recognition principle, and matching principle, as well as cash-basis and accrual accounting. There are also 2 case studies to explore and 5 practice quizzes.

| Topic | Time To Complete | |

|---|---|---|

| Week 1 | Accounting Concepts and Measurement | 4 hours |

| Week 2 | The Accounting Cycle (Part 1) | 4 hours |

| Week 3 | The Accounting Cycle (Part 2) | 5 hours |

| Week 4 | Accounting Principles and Practices | 4 hours |

2. Assets in Accounting

The second course in the Intuit Bookkeeping professional certificate dives deeper into the world of bookkeeping and accounting for assets. The course covers all common asset types, and how to account for inventory, cost of goods sold, and working with property, plant, and Equipment (PP&E) components. Students will learn how to summarize the common assets of businesses, describe the importance of inventory control, and explore depreciation.

This course consists of 19 hours of content, split into 4 weeks. The first week, which takes 5 hours to complete, includes 25 videos, 4 readings, and 6 quizzes.

During week 1, you’ll learn how to work with assets, account for sales, and deal with notes receivable and uncollectable accounts. There are insights into sale types, recording receipts, and managing invoices with software.

Week 2 looks at inventory accounting methods like the cost of goods sold, costing methods, and inventory management. You’ll look at common inventory, income, and balance errors, journal entries, and disclosures. There are also 4 practice exercises to complete.

In week 3, you’ll explore plant, property, and equipment concepts, as well as learn how depreciation works in companies, and how to deal with equipment leases.

There are 3 quizzes, and a PPE assessment to complete. Week 4 finishes the course with 5 hours of content covering how to apply accounting principles and knowledge. You’ll learn about accounting for the PP&E lifecycle and take 3 quizzes to showcase your knowledge.

| Topic | Time To Complete | |

|---|---|---|

| Week 1 | Accounting Concepts and Measurement | 5 hours |

| Week 2 | Inventory Accounting Methods | 4 hours |

| Week 3 | Property and Equipment | 5 hours |

| Week 4 | Applying Accounting Principles and Knowledge | 5 hours |

3. Liabilities and Equity in Accounting

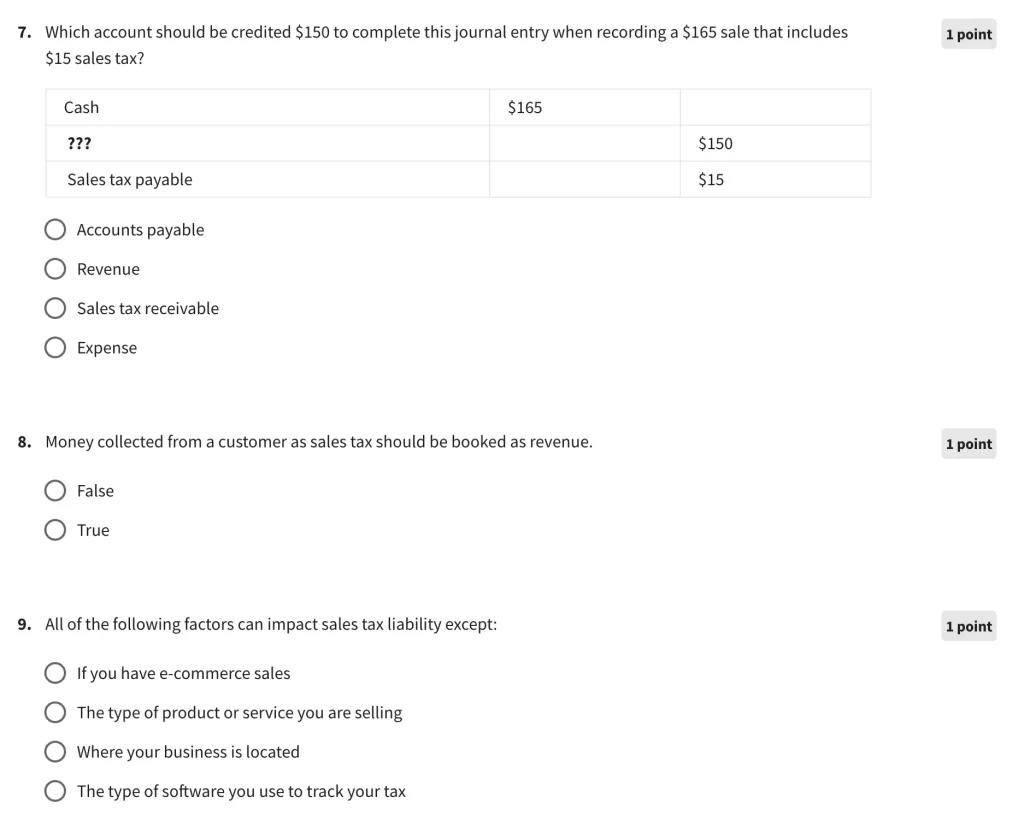

The third course in the Intuit Professional Bookkeeping Certificate explores liability and equity accounts, and how they influence the balance sheet. Students explore all kinds of liabilities, including payroll and sales tasks. Over 14 hours of study, you’ll learn how to describe the main characteristics of liabilities, compare different equity options, and use accounting equations.

In week 1 of the course, you’ll be introduced to different liabilities, and how to account for them using sales tax payable accounts. There’s guidance on discussing credit with clients, and managing lines of credit, with 3 useful quizzes for testing your knowledge.

Week 2 looks at payrolls, obligations, and loans, with 27 videos covering how to choose a payroll system, set up direct deposits, and track employee time.

Week 3 looks at Equity and Liabilities, with 18 videos introducing concepts like mortgages, bank loans, and amortization. Students also look at Stakeholder equity and can access 4 practice exercises to test their knowledge of bank loans, equity, and liabilities.

In the fourth week of the course, you’ll practice your knowledge by working through common accounting scenarios.

The fourth week looks at accounting errors, practicing payroll, and overviewing cash transactions. You’ll also learn about changes in equity driven by earnings and withdrawals. Plus, there are 4 practice exercises including a comprehensive assessment of equity and liability.

| Topic | Time To Complete | |

|---|---|---|

| Week 1 | Liabilities and Equity in Accounting | 3 hours |

| Week 2 | Payroll, Obligations, and Loans | 4 hours |

| Week 3 | Equity and Liabilities | 3 hours |

| Week 4 | Practice with Liabilities and Equity | 4 hours |

4. Financial Statement Analysis

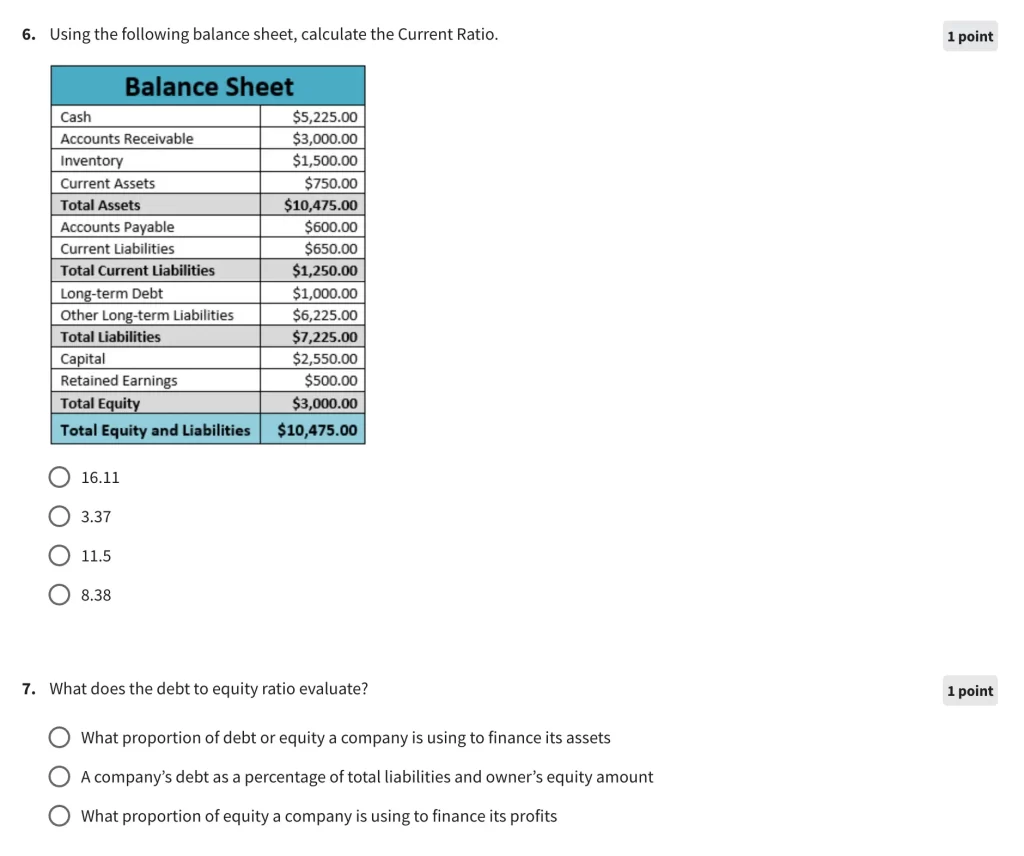

The fourth and final course in the Intuit Professional Bookkeeping certificate asks students to apply their existing knowledge to a financial statement analysis. Here, you’ll learn how to reconcile different account types, check for accuracy, and address common errors.

The 18 hours of resources guide students through the process of using bank reconciliations to control cash flow, outlining financial statements, and applying quantitative skills to business health.

In week 1, you’ll start with an overview of liabilities, how to account for them, and how to use sales tax payable accounts. The lessons cover everything from preparing for reconciliation to managing balance sheets and using QuickBooks online. There are various insights from professionals, as well as 4 practice exercises and a 1-hour assessment.

Week 2 looks at how to read financial statements and interpret balance sheets. There’s expert guidance on cash flow, and how to create statements of cash flow in QuickBooks online. Plus, there are quizzes to test your knowledge of cash flow interpretation.

Week 3 examines the steps involved in analyzing key reports and transactions. You’ll learn about income statement analysis, profit margins (gross, net, and operational), balance sheet analysis, and debt-to-equity ratios. There are exams on business communications, cash flow, and balance sheet management, and analyzing key reports.

Week 4 finishes the course by asking students to work through common accounting scenarios dealing with equity, payroll, and liabilities. You’ll run various reports using online software, and prepare for the Certified Intuit Bookkeeping exam.

| Topic | Time To Complete | |

|---|---|---|

| Week 1 | Understanding Reconciliations | 3 hours |

| Week 2 | How to Read Financial Statements | 4 hours |

| Week 3 | Analyzing Key Reports and Transactions | 5 hours |

| Week 4 | Application and Practice with Reconciliations and Financial Analysis | 6 hours |

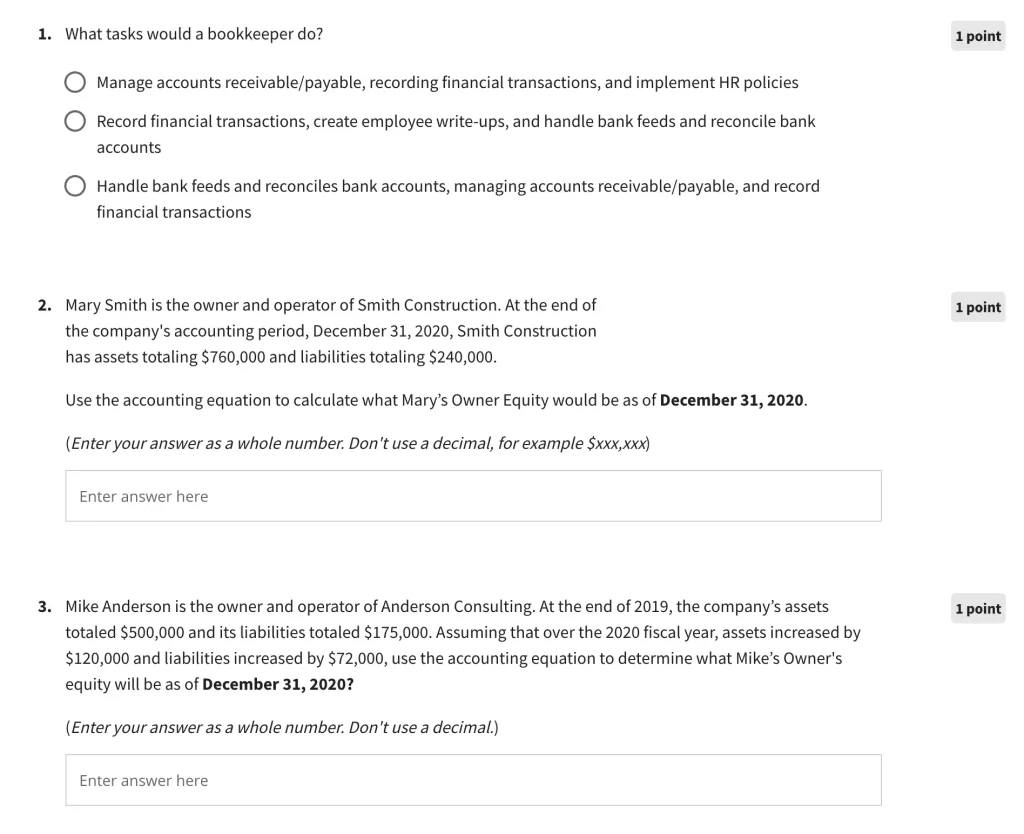

Intuit Bookkeeping Certificate Exams

To successfully complete the Intuit Bookkeeping Professional Certificate, you will need to finish all 4 modules, including the accompanying hands-on quizzes and projects involved in each course. All of the modules have their own quizzes accompanying each week of lessons, designed to test your skills.

Following the 4 courses, you will also need to sign up for and finish the Intuit Certified Bookkeeping Professional exam. This will require you to create a Pearson Vue account, where you can schedule and purchase your final exam. The exam costs $149 to take, and allows for both in-person and online testing, depending on your needs.

Finishing the exam will provide you with a digital badge and certification you can share when applying for all kinds of bookkeeping and accounting roles. If you do not achieve a passing score on the exam the first time, you will need to wait 24 hours before re-taking it. If you don’t achieve a passing score the second time, you’ll need to wait 5 days before applying again.

All original vouchers for your exam must be used before their expiration dates. Retake vouchers need to be used within 30 days of a failed exam. There are various tools to help you prepare for this final test throughout the four-course certification.

This is an example of how the exam questions looks like.

How Hard is the Intuit Bookkeeping Certificate?

The Intuit Bookkeeping Professional Certificate is designed specifically for beginners, with no prior knowledge or expertise in bookkeeping. You don’t need any specialist knowledge to get started, but it’s recommended you take each course in order to prepare for the upcoming lessons.

The lessons and modules are easy-to-follow and comprehensive, with plenty of practical examples, case studies, videos, and expert guidance. You’ll also be free to complete each of the modules at your own pace, and practice your skills using hands-on assignments and quizzes.

With various resources and downloadable content to guide you, as well as hands-on projects, you can easily prepare yourself for a career in bookkeeping and accounting. Every part of each course is divided into easily digestible segments.

Is the Intuit Bookkeeping Certificate Worth it?

If you’re interested in a bookkeeping or accounting career, this course is definitely worthwhile.

According to the Bureau of Labor Statistics, the demand for bookkeepers and accountants is relatively steady, with an average median salary of around $45,560 for professionals. While this landscape isn’t growing as quickly as some other areas, bookkeeping roles can be extremely lucrative and stable, as companies will always need professionals to help them manage their accounts.

Companies in every industry need to work with bookkeeping specialists to ensure they can submit tax returns, and monitor their profit and loss over extended periods. The Intuit Bookkeeping Professional Certificate will give you the insights and expertise you need to apply for bookkeeping roles in virtually every industry. You’ll also develop crucial insights into how to use critical software tools.

Certified by Intuit, a leader in the bookkeeping world, this course is well-respected by industry leaders, and excellent for expanding your resume. You’ll also get guidance on how to apply for your new role in the bookkeeping world with market-leading brands.

Related Courses and Certifications

- Best Business Courses - a list of courses to help you build the skills needed to run a business.

- Best Entrepreneurship Courses - a list of courses for becoming a great entrepreneur.

- Best Google Certifications - a list of the best Google professional certifications to pursue and build job-ready skills.

- Best Bookkeeping Certifications - a list of the top bookkeeping courses to follow and become certified.